Timing is everything.

You've heard that phrase applied to a lot of things in life, and it also applies in real estate. Home buyers know that it's best -- when possible -- to time their home purchase when interest rates and/or home prices are low.

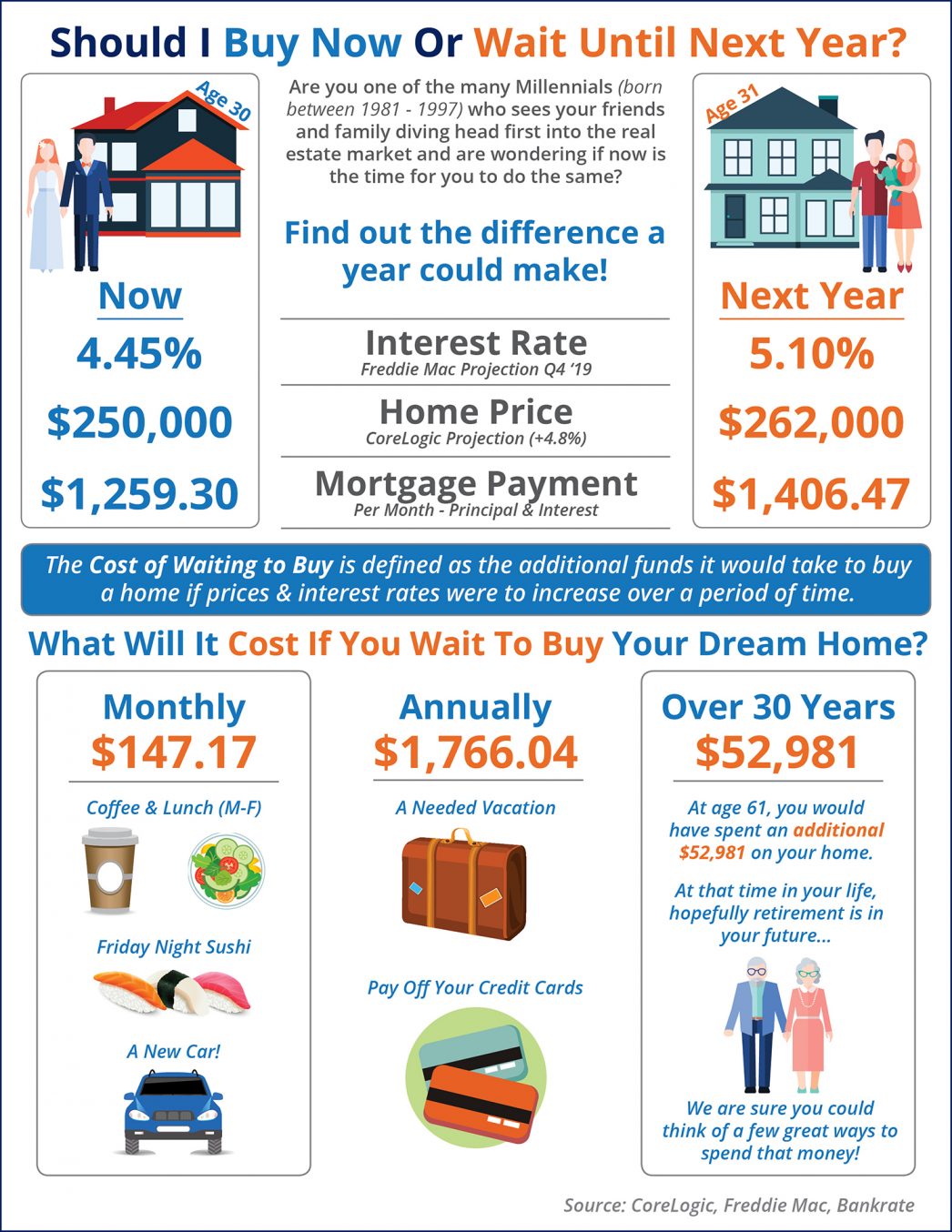

Neither of those are at historic lows right now, but industry experts expect both interest rates and home prices to go up over the next year.

What's that mean to you as a future home buyer? Well, it could mean a lot more money out of your pocket. How much? If forecasts are correct, waiting a year to buy a home could mean about $150/month more for your mortgage payment -- almost $1800 per year.

Are you ready to buy?

That's an important question to consider. We'd never suggest anyone buy a home unless s/he's fully prepared to do so -- a lot of people do that when they're not ready and it leads to problems.

To find out if you're ready, please think about the six questions in our article: How Do I Know If I'm Ready To Buy A Home?

If you answer yes to those questions, we'd love to help you find the perfect home and save some money. If you're not ready yet, that's okay, too -- and good for you for doing what's best in your current circumstances!